A love letter to accountants everywhere

Sonke we love money, plus we all understand how important making money is to our sense of value and overall well being (ever heard of “net worth”?). In business especially, our finances essentially define our company’s performance over any given period.

“ When it comes to our financials; we shouldn’t be putting out fires. Ideally, our books should help us see how we’ve been doing or how we’ll be doing in 2 or 3 years’ time. Are we on track for our strategies? ” – Sizwe Mbilase

When it comes to reporting, presenting, analysing or managing our business’ financial performance, there are two key “statements” we can rely on:

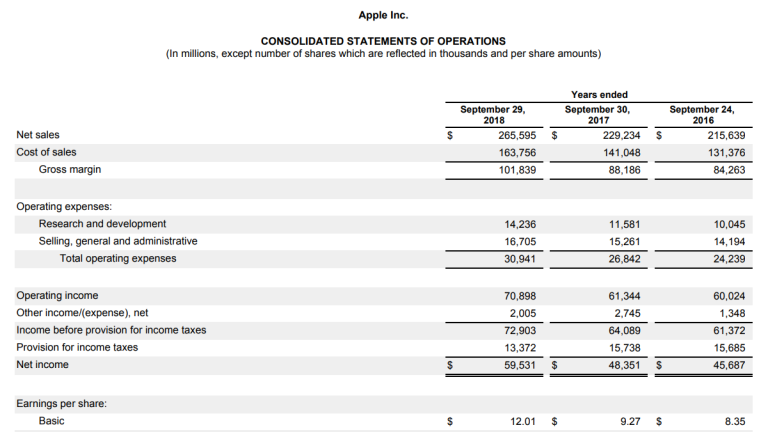

1. Income Statement

Your income statement, sometimes called a “statement of financial performance” is your first line of defense against investors, directors and shareholders etc.

This document (Sizwe recommends using Excel) outlines all the revenue (operating income), any other income and expenses of a business over a financial period [i.e. a year, a quarter, a month etc.]

The “bottom-line” of an Income Statement clearly shows how much profit or loss a business has made over the specified period; accounting for sales, interest, taxes and any other operating and non-operating transactions.

Financial statements can be as simple or as complex as you want them to be, as long as they state all the necessary info in a readable manner.

Publicly traded companies usually have to provide quarterly and yearly financial statements to shareholders and the public (in accordance with GAAP). Investors, banks and SARS may also be particularly interested in how much sales, expenses and the overall profit a business records over a particular period.

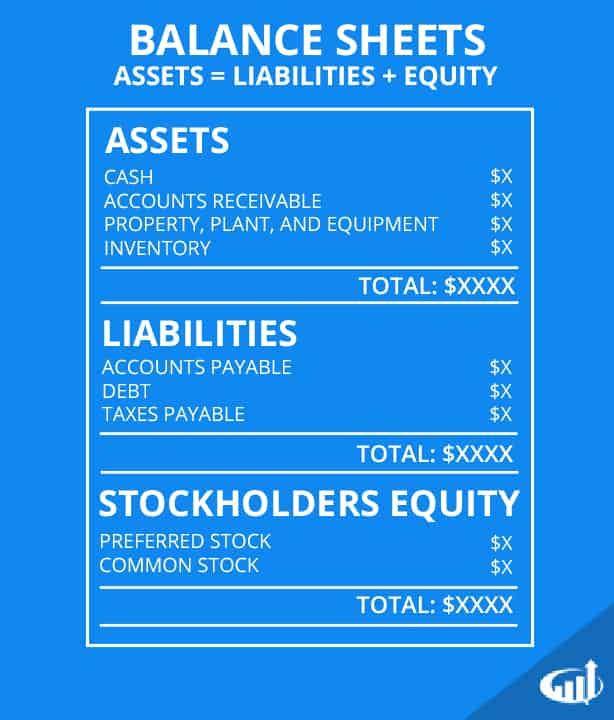

2. Balance Sheet Statement

“…a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.” – From Investopedia

Beyond Income Statements, a business has to account for debts, uncollected payments and assets acquired even before the current financial period. A Balance Sheet, sometimes called a “statement of financial position” gives us a picture of everything a business owns vs. everything a business owes at a specific point in time.

This video explained it really well

To really understand the parts of a balance sheet statement, we first have to understand The Accounting Equation:

Total Assets = Liabilities + Owner’s Equity

At any point in time, if we added up a business’ total assets they’d be equal to its total liabilities (it always balances). “Assets” mean everything the business owns, while “total liabilities” refer to everything the business owes to outsiders (e.g. bank loans) and its owners (equity).

In a little more detail, equity includes the total value of the owners’ shares and any money or value they put into the business. In this sense, it is crucial to understand that any contribution an owner makes or any stake they have in a business can be regarded as a loan that the business may have to pay back at a later date.

The balancing act

A Balance Sheet Statement begins by laying out the 3 headings in the equation above (Assets, Liabilities & Equity). After that it’s a matter of putting each value under its correct heading. The document is completed when the accounting equation “balances” (i.e Assets = Liabilities + Owners Equity). If not, then it means something is missing.

The document itself is one of the ways companies can be sure of their overall value, even when they are currently recording losses. In many cases, companies with a lot of value in assets are able to make investors see beyond negative profits.

On bookkeeping:

“ Honestly, no one likes to do it, but someone in the business has to. It’s a task that’s super-effective in any situation where you need to know or show how your business is doing. ” – Sizwe

In addition to the income statement and balance sheet, there is another big bru called the Cash Flow statement. You can read a bit about that here.

From our side, this concludes our ‘Getting in Touch with your Financial Side’ series. Below we have 7 things you can do to start up your finances (in as little as 1 hour every week):

- Setup your Income Statement

- Setup your Balance Sheet

- Make a plan to update them regularly

- Keep slips/ invoices, otherwise use one account so your bank statement can track your transactions

- Beware of taxes and any similar (non-negotiable) costs that are coming in the future. Good news, if you’re registered as a small business, you don’t have to pay income tax until you start making more than R83 000 within a specific tax year (as of 2020). Read a bit more about tax on the SARS website.

- Keep track of the money or services you “loan” to your company, you still have to be paid for this.

- Whenever the chance or need arises, study your books to gain insights about your business.

Where does most of your money come from? Where are you losing money? What can you do to your finances to get closer to your vision/ mission?

Last but not least, remember…!

- If your business is feeling lost, it’s probably because you’re not following the money.

- It’s never too late to start setting up your finances, but the longer you leave it, the more complicated it’ll get.

If you’re feeling particularly motivated to get this money, you should check out this video of Sizwe’s presentation about a similar topic (imali) at the Hive some time last year:

Written by: Lungelo Hlela (I am Multeemedia) // Images taken by: @dayphotolife

– – – – –

Lungelo Samkelo Hlela has won (Loerie, Bookmark & Creative Circle) awards for his work as a digital copywriter. With “nothing to share”; he has been a contributing writer on our blog since 2018.